Financial Cascade Failure

I’ve been reading quite a bit about the economics of the financial sector, and have come to two interesting conclusions.

One is that the fractional reserve and central banking systems are very much akin to a Ponzi scheme; except that once it reaches scale, it doesn’t necessarily have to collapse. Bankers can rake in a hefty sum by arbitraging the difference in interest rates. You deposit (lend) money to the bank for which they pay out a ‘generous’ 5%. The bank then lends out 90% (or more) of that deposit to fund car and house purchases, small business loans, etc; on which they collect 15%. Assuming a finite amount of money in the system, some of these loans will go bust, allowing the bank to acquire the collateral (a tangible asset of real value). The fact that much of the money is created via loans, instead of being backed by physical reality, guarantees that some debtors go bankrupt; an evolutionary pressure for debtors to succeed in business.

The second is that this system represents an unstable equilibrium. As long as people manage to find ways of paying back the credit, things go smoothly. But this cannot last, for the compounding interest causes defaults; which eventually become large enough to disrupt the fabric of the system. For the banks are really only as good as the loans they handed out. FDIC and other government measures have encouraged banks to take on more risk (and promise of higher profits). New mathematical wizardry has allowed the banks to sell that risk to other institutions. So that we now have such a complicated web of debt not even ratings agencies can accurately compute the risk. If one bank with enough ties to the system defaults, the credit stress it puts on fellow institutions can cause them to tighten their belts (or go under). The reduction in credit proceeds as a cascade failure throughout the system.

I have a modest proposal that might help to alleviate these problems. First, we need open accountability, so that we can asses the risks in individual banks, and the system as a whole. This can actually help the banks when dealing with each other; no longer do they have to partner on the faithful basis of reputation. They can make these decisions rationally on the basis of financial solvency as it appears in the public record. But how to represent this information in a meaningful form?

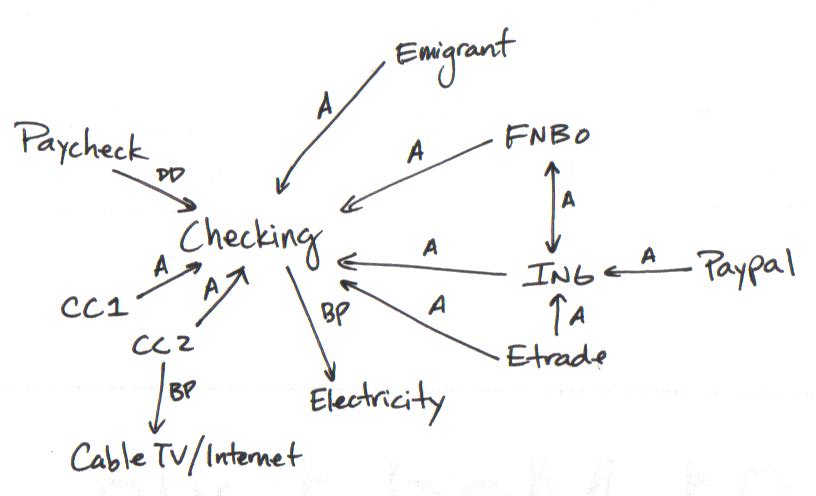

I’ve already described the world of finance as a network of credit and debt. Money flows between institutions in the form of loans and payment for services. Clearly it’s possible to draw a balance sheet in this manner. Lifehacker’s article on financial network maps was the only place online that I could find where this idea has been carried out. I’m sure it’s not well practiced among business accountants. If each bank publishes such an account, then we can collect them and form a global financial network of money flow.

The cascade failure in the banking network is the same as that in other systems: species extinction in ecology, wide-scale power outages in the electric grid, etc. Based on the research that I did previously, Preventing Cascade Failure in Networks and Revisiting Cascade, I don’t know if any mechanism of decentralized autonomy with localized response can really solve the problem.

In any case, risk is no longer a simple calculation. Once you take into account the counterparty potential for default, the risk function looks decidedly non-linear. However, an easily calculated metric would be some variant of PageRank, TrustRank or network centrality measure.

Damn you need facebook or some other social integration on this shiz.

Anyway, so, another solution to the problems created by the fractional reserve and central banking system is by eliminating them, especially fractional reserve banking. The purpose of fractional reserve banking is primarily the profit of the bankers, not the good of the society the bankers are serving.

I really don’t think that getting entirely rid of the fractional reserve system is the appropriate fix. I mean, you don’t expect for a bank (which has employee and service expenses, as well as the large capital expenses of a physical vault) would store your monies without some fee, do you? Much better for them (and for you) if they pay you interest on the money they ‘hold’ for the permission of lending it out. Perhaps we can compromise on 90% reserves instead?

It used to be that this blog was auto-imported to my Facebook account as FB notes, but FB stopped providing that service last month.